Prop Firm’s Solution

HFT Bot Prop Firm

Our HFT Bot Prop Firm can pass your challenge. Use the 24/7 available live chat below to get started, our average response time is 5 minutes.

*We only take a few spots per month to avoid prop firm maximum capital allocation for EA! 30 Days Risk Free Guarantee!

Pricing

HFT Bot Prop Firm Price

Basic

- Monthly fee

- Only $5k account size

- One account license

- 15% commission on payouts

- 8% – 16% monthly

- 10% max dd

- Customised set file per client

- 500+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Personal

- Monthly fee

- $5k – $199k

- One account license

- 15% commission on payouts

- 8% – 16% monthly

- 10% max dd

- Customised set file per client

- 500+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Deluxe

- Monthly fee

- $200k – $1M

- One account license

- 15% commission on payouts

- 8% – 16% monthly

- 10% max dd

- Customised set file per client

- 500+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Pro

- One time fee

- $5k – $1M

- Unlimited license

- 0% commission on payouts

- 8% – 16% monthly

- 10% max dd

- Customised set file per client

- 500+ clients funded

- 96.8% challenge pass rate

- 24/7 Support

- 30 days risk free guarantee

Enterprise

- MQ4 & MQ5 source code file

- 24/7 Support

- 30 days risk free guarantee

Having problem with payment?

FAQ

How can i contact you?

We are available 24/7 on telegram

Send us a message, our average response time is 5 minutes or email support@hftbotpropfirm.com

Why Choose HFT Bot Prop Firm?

In the dynamic world of trading, where uncertainty and risk are ever-present, HFT Bot Prop Firm emerges as a beacon of strategic innovation. This Expert Advisor (EA) is not just a tool; it’s a comprehensive solution for traders navigating the challenging waters of trading competitions.

One of the most compelling reasons to choose HFT Bot Prop Firm is its unique hedging strategy. By executing opposite trades in a challenge account and a live account simultaneously, it offers a balanced approach to risk management. This method is particularly beneficial in scenarios where a challenge is lost, as HFT Bot Prop Firm aims to recover the costs in the live account, thereby cushioning financial setbacks.

Moreover, the EA’s user-friendly interface is a significant advantage, especially for traders who may not have extensive experience in using EAs. It demystifies the often complex world of automated trading, making it accessible and manageable. This ease of use does not come at the expense of versatility. HFT Bot Prop Firm is adaptable to various trading platforms and challenges, ensuring that it remains a relevant tool regardless of the trading environment.

Another key aspect of HFT Bot Prop Firm is its focus on financial planning. In trading challenges, where the allocation of funds and management of potential losses are crucial, HFT Bot Prop Firm provides a structured approach to maintaining financial stability. It’s not just about making profitable trades; it’s about smartly managing the financial journey through the ups and downs of trading competitions.

Furthermore, the adaptability of HFT Bot Prop Firm to different market conditions and its ability to use one license for multiple challenges make it a cost-effective option. It’s an investment in a tool that offers more than just executing trades; it provides peace of mind, strategic depth, and a pathway to potentially more consistent trading outcomes. In essence, choosing HFT Bot Prop Firm is a wise decision for traders who seek a blend of risk management, financial prudence, and strategic trading in their journey through the competitive world of trading.

How does the HFT Bot Prop Firm work?

HFT Bot Prop Firm operates on a sophisticated yet user-friendly platform, designed to cater to the needs of traders engaged in various trading challenges. At its core, the EA employs a unique hedging strategy. This involves executing simultaneous trades in two different accounts: a challenge account and a live account. When a buy order is placed in the challenge account, a corresponding sell order is executed in the live account, and vice versa. This approach is aimed at balancing the risks associated with trading competitions, where the outcome can be unpredictable.

The real ingenuity of HFT Bot Prop Firm lies in its cost recovery mechanism. In scenarios where a trader faces a loss in the challenge account, the EA aims to offset this loss by making profitable trades in the live account. Essentially, if the challenge is lost, the EA’s strategy is to recover the cost of the challenge through successful trades in the live account. This feature is particularly appealing to traders as it provides a safety net, reducing the financial impact of unsuccessful challenges.

Furthermore, our EA is designed with a user-friendly interface, making it accessible to traders of varying levels of experience. Its settings can be easily configured to suit different trading styles and requirements. The EA is adaptable to various trading platforms, ensuring its functionality in diverse trading environments. Additionally, the flexibility of using one license for multiple challenges adds to its cost-effectiveness, making HFT Bot Prop Firm a practical tool for traders looking to optimize their performance in trading competitions.

What is a Prop Firm Expert Advisor (EA)?

HFT Bot Prop Firm is an innovative Expert Advisor (EA) designed for traders participating in various trading challenges. It operates on a unique hedging strategy, simultaneously executing buy orders in a challenge account and sell orders in a live account. This approach aims to balance the financial risks associated with trading challenges. If a challenge is lost, HFT Bot Prop Firm seeks to recover the incurred costs in the live account, effectively minimizing potential losses. Its user-friendly interface makes it accessible to traders of all experience levels, and it’s adaptable to different trading platforms and challenges. The EA represents a blend of strategic trading, risk management, and financial planning, making it a valuable tool for traders looking to navigate the complexities of trading challenges.

Key Features of HFT Bot Prop Firm:

► Hedging Expert Advisor: Utilizes a unique strategy to manage trading risks.

► Simultaneous Buy and Sell Orders: Executes opposite trades in challenge and live accounts.

► Cost Recovery Mechanism: Aims to recover challenge costs through live account trades.

► User-Friendly Interface: Accessible to traders of varying experience levels.

► Adaptable to Various Platforms: Compatible with different trading challenges and platforms.

► Strategic Trading Tool: Combines trading strategy with risk management.

► Financial Planning Aid: Helps in minimizing potential losses in trading challenges.

A Prop Firm Expert Advisor (EA) is an automated trading system designed to assist traders in executing trades within proprietary trading firms’ accounts. These EAs are programmed to analyze market conditions, identify trading opportunities, and execute trades based on predefined strategies without the need for constant human intervention.

General Features:

Automation: EAs automate trading processes, allowing traders to execute strategies without manual input.

Algorithmic Trading: They use algorithms based on technical indicators and trading signals to make decisions.

Customizability: Many EAs can be tailored to fit individual trading strategies and risk preferences.

HFT Bot Prop Firm operate by utilizing algorithms that process real-time market data to generate trading signals. Here’s a breakdown of how they work:

Steps Involved:

Data Analysis: The EA analyzes various market indicators, including price movements, volume, and trends.

Signal Generation: Based on the analysis, the HFT Bot Prop Firm generates buy or sell signals when specific conditions are met.

Trade Execution: The HFT Bot Prop Firm automatically places trades on behalf of the trader, following the parameters set in its programming.

Risk Management: Our EA incorporate risk management features, such as stop-loss and take-profit orders, to protect capital.

Is your HFT Bot Prop Firm allowed by prop firms?

Yes, prop firms allow our prop firm ea and the use of EAs (Expert Advisors). Here’s a link with all of the prop firms that allow EA trading: https://forexpropreviews.com/which-prop-firms-allow-eas/

Using a HFT Bot Prop Firm can offer several advantages for traders, particularly in high-pressure environments like proprietary trading firms.

Advantages:

Emotion-Free Trading: EAs operate based on logic and predefined rules, eliminating emotional decision-making that can lead to mistakes.

Increased Efficiency: Automated trading allows for the execution of trades at any time, even when the trader is unavailable.

Backtesting: Traders can backtest EAs using historical data to assess their effectiveness before deploying them in live trading.

Consistent Strategy Execution: EAs ensure that trading strategies are executed consistently without deviations.

While HFT Bot Prop Firm can be beneficial, they may not be suitable for every trader. Here are some considerations:

Suitability:

Experience Level: EAs can be more effective for traders who understand algorithmic trading and have a clear strategy. Beginners might struggle without a foundational knowledge of trading principles.

Trading Style: EAs are often best suited for traders who prefer a systematic approach. Scalpers, swing traders, and day traders may find EAs useful, while discretionary traders may prefer manual trading.

Market Conditions: EAs may perform differently in varying market conditions. Traders need to understand when their EA works best and when it may require adjustments.

How long does it take to pass the challenge?

It depends on the risk settings you apply. Once you purchase the EA you will get a sheet with the optimal risk parameters for every account size. Nonetheless, with our risk parameters every challenge can be passed within the required time.

Traders can use multiple EAs simultaneously, but there are important considerations to keep in mind:

Considerations:

Diversification: Using multiple EAs can diversify your trading strategies and reduce risk. Different EAs may perform well under various market conditions.

Resource Allocation: Running multiple EAs can consume significant computational resources, which may slow down performance. Ensure your trading setup can handle this.

Monitoring: While EAs are automated, it’s essential to monitor their performance regularly. Having multiple EAs means managing and evaluating each one’s effectiveness.

Can I use your HFT Bot Prop Firm on funded accounts?

Definitely! You can use it on both Challenge and Funded accounts.

Choosing the right HFT Bot Prop Firm involves careful evaluation. Here are key factors to consider:

Key Factors:

Performance History: Look for EAs with a proven track record. Analyze their historical performance and how they have responded to different market conditions.

Customization Options: Ensure the EA can be tailored to fit your specific trading strategy and risk tolerance.

Risk Management Features: The EA should incorporate robust risk management tools, including stop-loss and take-profit settings.

User Reviews and Reputation: Research user feedback and reviews to gauge the reliability and effectiveness of the EA.

Compatibility: Ensure that the EA is compatible with the trading platform used by the prop firm.

HFT Bot Prop Firm excels in trading multiple symbols simultaneously, enhancing its versatility for traders. This feature allows for diversification across different markets, spreading risk and increasing profit opportunities. Traders can engage in various currency pairs or commodities, and HFT Bot Prop Firm manages these with precision, leveraging market conditions and trends.

Its sophisticated algorithm efficiently handles multiple symbols, maintaining performance and effectiveness. This multi-symbol trading capability is ideal for traders aiming to expand their portfolios and explore new markets.

Additionally, HFT Bot Prop Firm integrates this feature with its robust risk management system, ensuring overall risk remains controlled. This combination of trading multiple symbols and effective risk management positions HFT Bot Prop Firm as a comprehensive tool for diversified trading strategies.

Why choose HFT Bot Prop Firm instead of a passing service?

Passing services that include trading by other people are against the rules of all prop firms. You risk to lose your account if you share your login details with someone else to pass your challenge.

EAs are allowed by almost all prop firms and you never have to share your login details with anyone else.

Optimizing an EA can significantly enhance its performance. Here are some steps to consider:

Optimization Steps:

Backtesting: Our EA use historical data to test the EA’s performance under various market conditions. Analyze its effectiveness and make necessary adjustments.

Parameter Adjustments: HFT Bot Prop Firm experiment with different settings and parameters to find the optimal configuration for the EA.

Regular Updates: HFT Bot Prop Firm keep the EA updated to adapt to changing market conditions and incorporate new strategies or insights.

Risk Management: The EA continuously review and adjust risk management settings to align with current market volatility and personal risk tolerance.

What account sizes can I use it on and price?

You can use it on any account size.

The cost of using a HFT Bot Prop Firm can vary widely depending on several factors, including the developer, features, and subscription models. HFT Bot Prop Firm offers both monthly and one time fees.

HFT Bot Prop Firm is designed with a variety of adjustable settings, catering to the diverse needs of traders in prop firm challenges. A key feature is the news filter, which allows users to align the EA with the specific phase of their prop firm challenge, ensuring it meets the varying requirements and risk parameters at different stages.

Another significant aspect is the ability to set max loss and max gain. These parameters enable traders to define their desired profit goals and the level of risk they are willing to accept, balancing aggressive trading for higher profits against conservative strategies for capital protection.

The EA also includes a setting for aligning with the requirements of many prop firms that mandate active trading days, thus ensuring compliance with challenge rules. Additionally, the max loss setting is pivotal in the EA’s risk management strategy, as it calculates the amount to be hedged in the live account to recover the cost of the challenge.

Lastly, HFT Bot Prop Firm offers the flexibility to select trading symbols, allowing traders to operate in markets they are most comfortable with or find most profitable. Overall, the settings of HFT Bot Prop Firm are designed for comprehensive customization, providing a user-friendly experience tailored to individual trading styles and challenge requirements.

Can I use your EA on funded accounts and why?

Definitely! You can use our EA on both Challenge and Funded accounts.

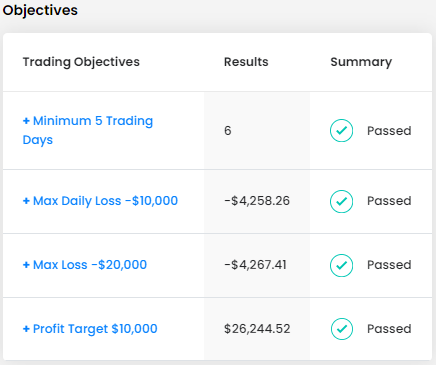

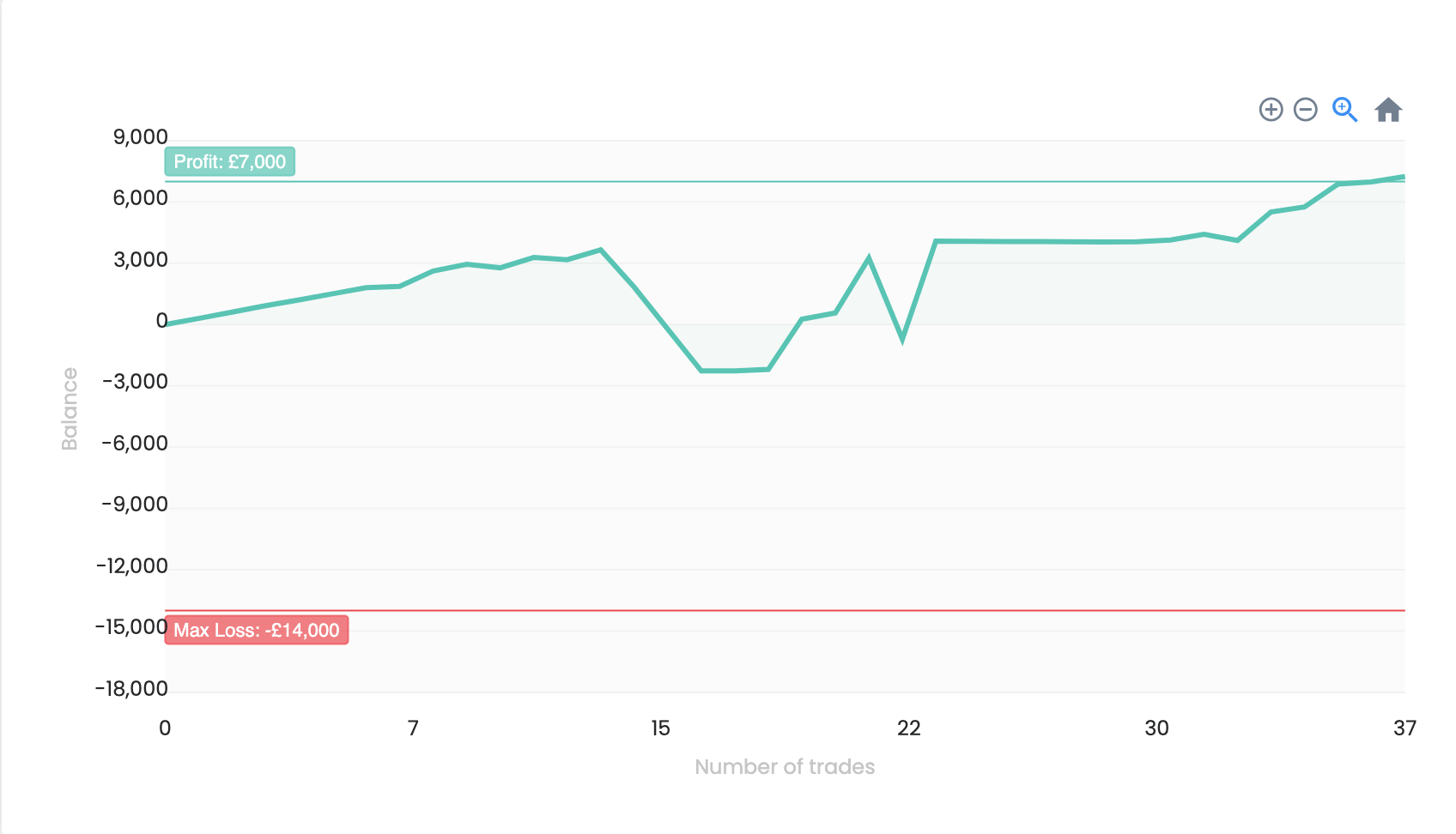

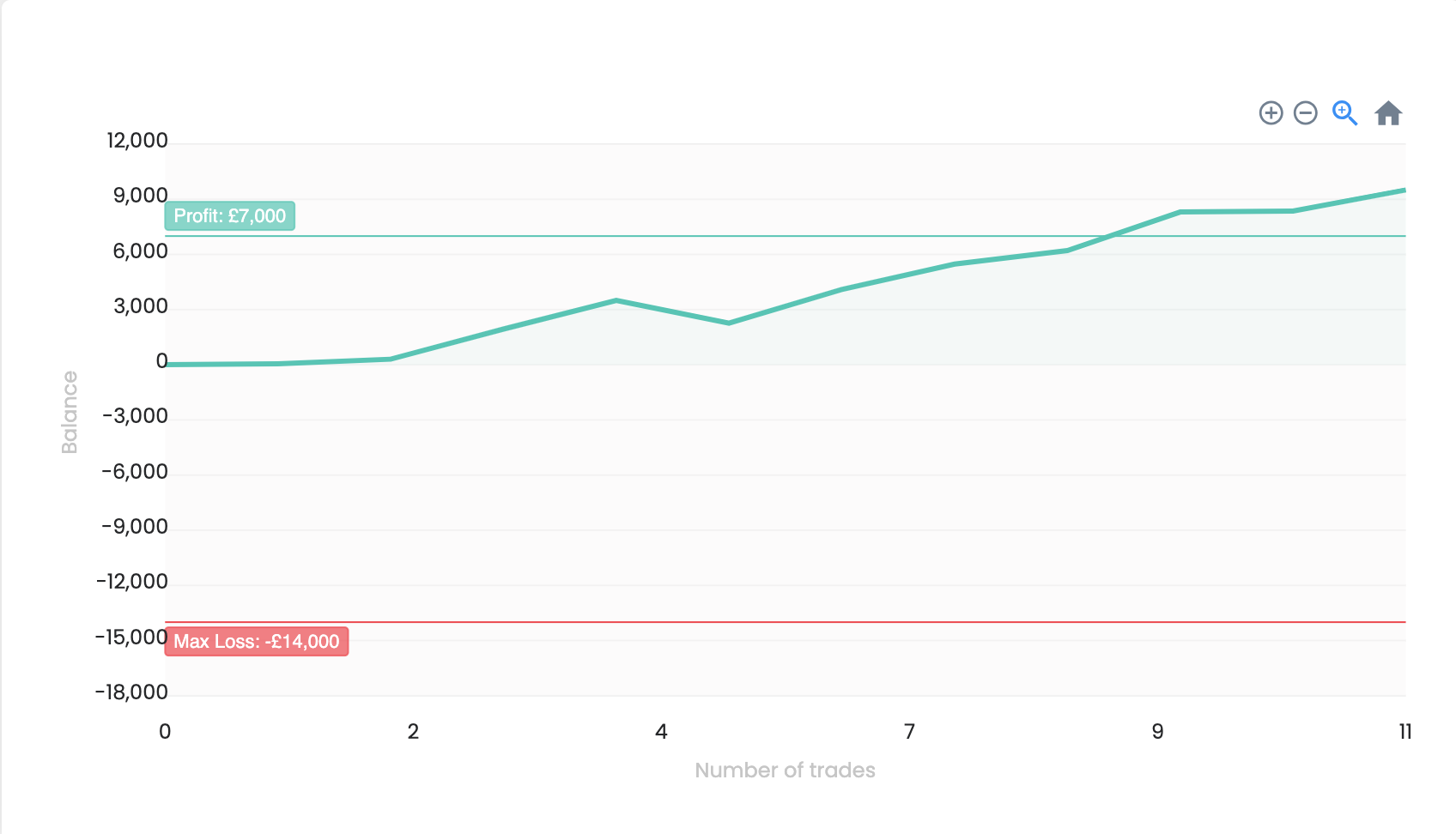

HFT Bot Prop Firm demonstrates impressive adaptability and strategic depth on funded accounts, particularly evident in its performance with a 200K FTMO account. Initially facing challenges with some losses, HFT Bot Prop Firm showcased its resilience by making profitable trades, highlighting its potential to bounce back in volatile market conditions. This performance underscores the EA’s capability to navigate through the complexities of trading challenges effectively.

A key strength of the EA is its innovative hedging strategy. It adeptly buys in a challenge account while simultaneously selling in a live account, effectively balancing the trading equation. This approach is particularly beneficial in scenarios where a challenge is lost, as it aims to recover the challenge costs in the live account, thereby minimizing financial risks and maximizing opportunities for profit.

The financial outcomes from using our EA are promising. It successfully recovered the cost of a lost challenge in the live account, demonstrating its efficiency in financial risk management. This ability to offset losses with gains in different trading scenarios showcases HFT Bot Prop Firm as a valuable tool for traders seeking a balanced and strategic approach to trading challenges.

How Can I Ensure My HFT Bot Prop Firm Is Compliant with Firm Regulations?

The prop firm trading world is challenging, with a high failure rate of over 95% for traders attempting to pass verification levels for funded accounts. To address this, a new system has been developed to help traders navigate both the challenges of passing prop firm tests and managing funded accounts with minimal risk and potential for high returns.

This system stands out for its universal compatibility with all prop firms and their diverse trading rules. It is designed to adapt seamlessly to various requirements, making it a versatile tool for traders. Additionally, it supports both MetaTrader4 and MetaTrader5 platforms, ensuring ease of integration into traders’ existing setups. This compatibility is crucial for traders to utilize familiar tools and focus on refining their trading strategies.

In essence, this system offers a comprehensive solution to the complexities of prop trading, aiming to reduce risks and enhance the potential for profitable returns in a highly competitive environment.

When using an EA in a prop firm, compliance with the firm’s regulations is critical. Here are steps to ensure compliance:

Compliance Steps:

Review Firm Policies: Familiarize yourself with the prop firm’s policies regarding automated trading and the use of EAs.

Seek Approval: Some firms may require prior approval for using automated systems. Always communicate with your firm to avoid any issues.

Adhere to Trading Limits: Ensure that your EA settings complies with any trading limits or rules established by the prop firm, such as maximum drawdown and leverage restrictions.

Regular Reporting: Be prepared to provide regular performance reports to the firm, detailing how the EA has been performing and adhering to established guidelines.

Pass your prop firm challenge with our HFT Bot Prop Firm. Enjoy consistent and passive profits every single day from only $50 per month.

90% OF TRADERS FAIL THE CHALLENGE

According to FTMO, only 10% of people who try their challenges actually pass them. We know how hard it is to pass prop firm challenges. The odds are not in your favor and the rules make it very hard for most traders to make any progress. That’s why we specifically designed a HFT Bot Prop Firm to pass your challenge so you can relax and watch it do its job. Once purchased you can use the trading bot for as many challenges as you wish and you can even let it trade on your funded account for passive income!

Why Choose Us

10X Your Profit Splits With Our Personalized prop Farming Model

Prop Farming Blueprint is the exact blueprint for how anyone can make money “Prop Farming” without risking any of your own capital.

HFT Bot Prop Firm Milestones

Customised set file per client

500+ Clients Funded

96.8% Challenge Pass Rate

Unlimited Accounts License

30 Days Risk free Guarantee

Outsmart the trading firms

Tired of failing prop firm challenges? Let our HFT Bot Prop Firm do it for you! You will never have to worry about hitting the max loss limit ever again!

We only take a few spots per month! 30 Day Risk Free Guarantee!

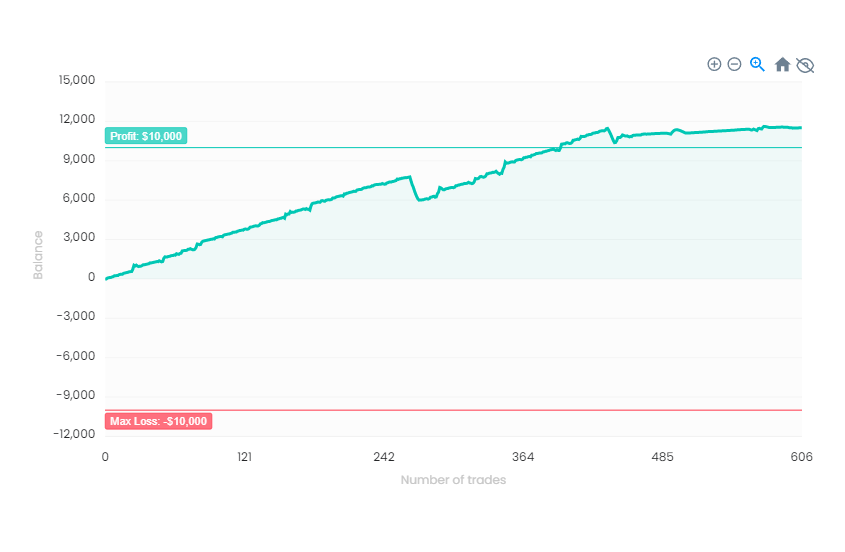

Our results aren’t just numbers, they’re real proves

$100M+

Funded with our EA

$3.5M

Startup capital raised

8% to 16%

Average monthly returns

“I purchased the MT5 version 6 days ago, completed the first phase of the challenge, and posted a proof in the VIP group. I also purchased the MT4 versions today in order to compare the results. Good job!

United States